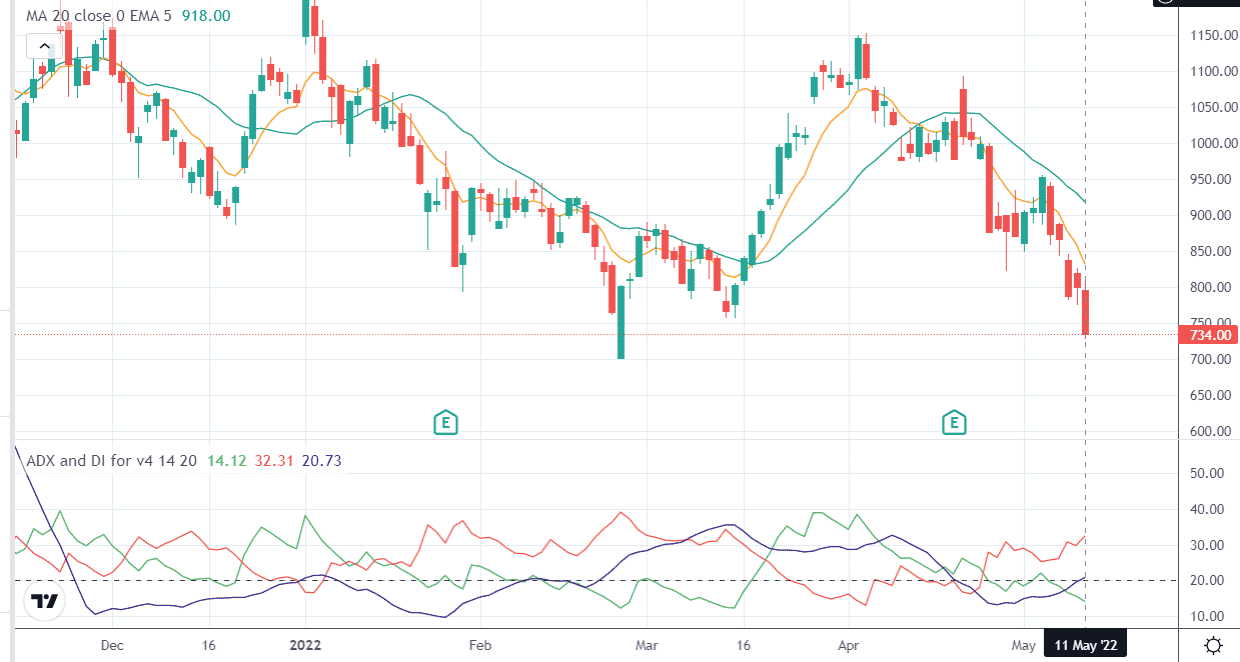

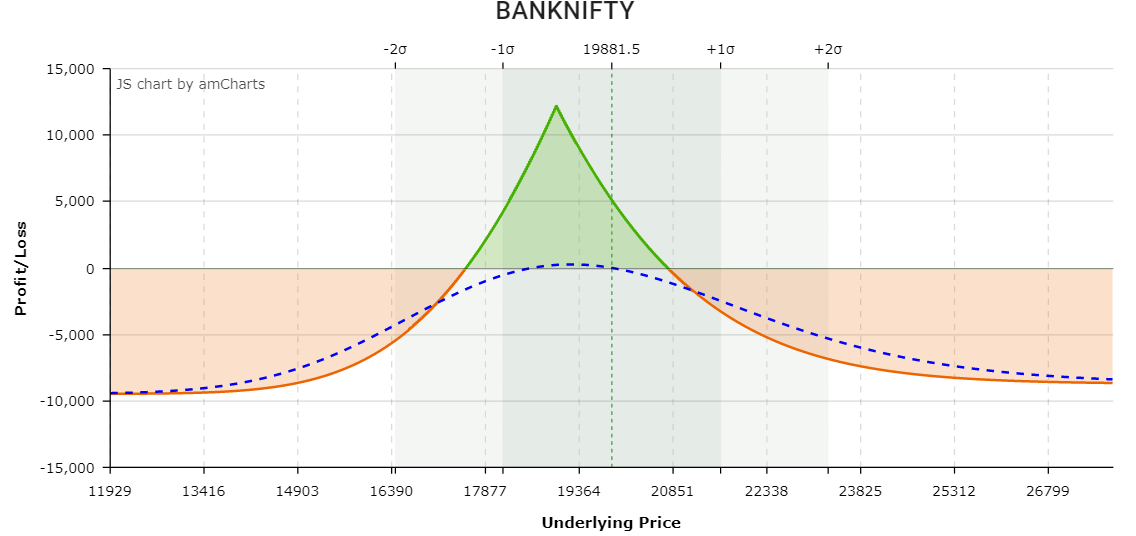

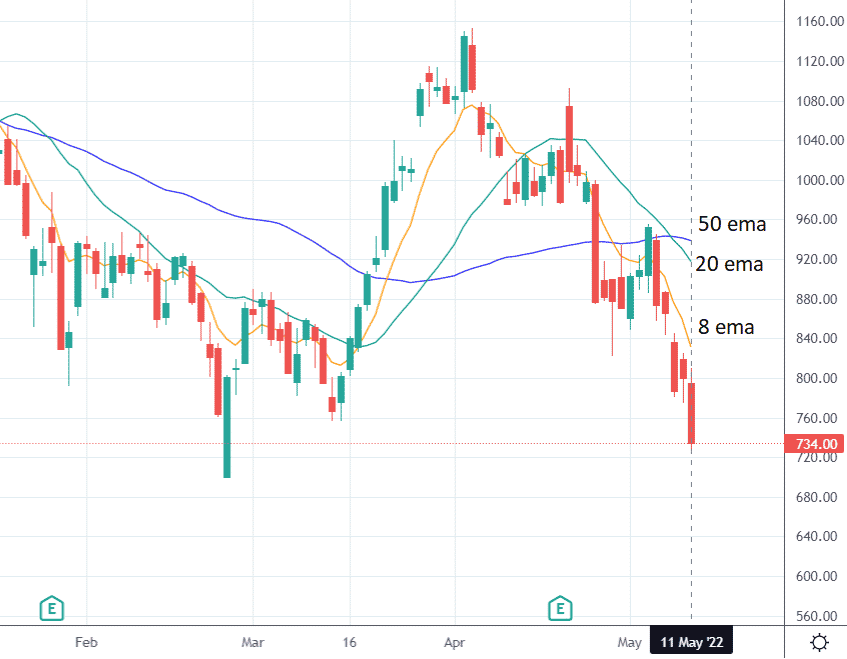

Put Calendar Spread - Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Short put mit basispreis a und nahem verfallsdatum Web click anywhere in the blank calendar to make it the active calendar. Der long put sollte einen monat später fällig werden als der short put. Web ein long put calendar spread, auch bekannt als „time spread“ oder „horizontal spread“, ähnelt seinem gegenstück long call calendar spread. Type your message, then put the cursor where you want to insert the calendar info. Web click on settings > view all outlook settings. As the price goes down, implied volatility usually goes up. Die long put calendar spread optionsstrategie basiert auf dem verkauf eines short puts. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

Bearish Put Calendar Spread Option Strategy Guide

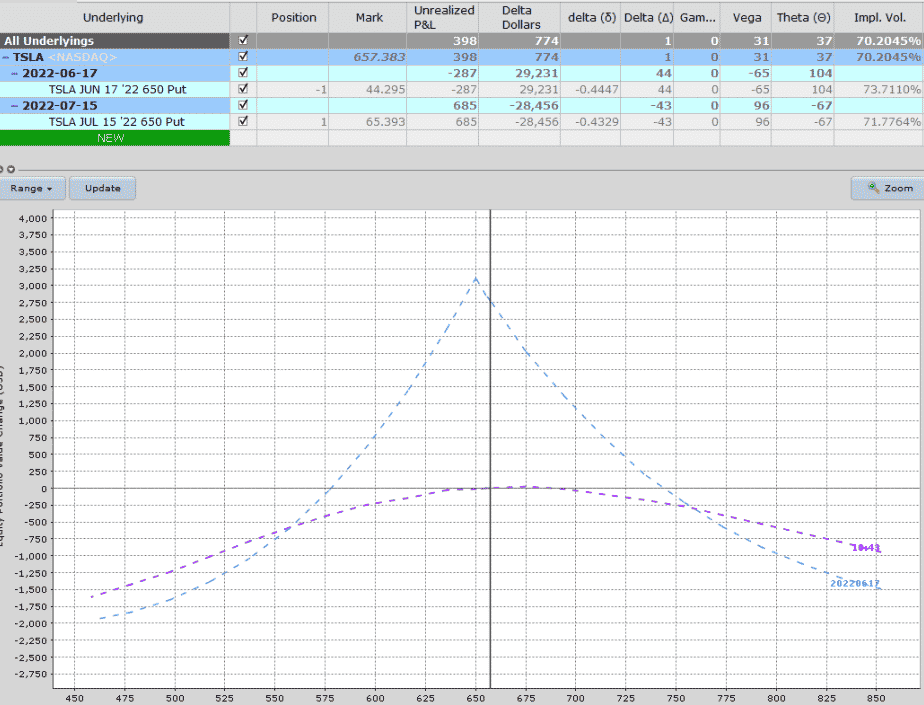

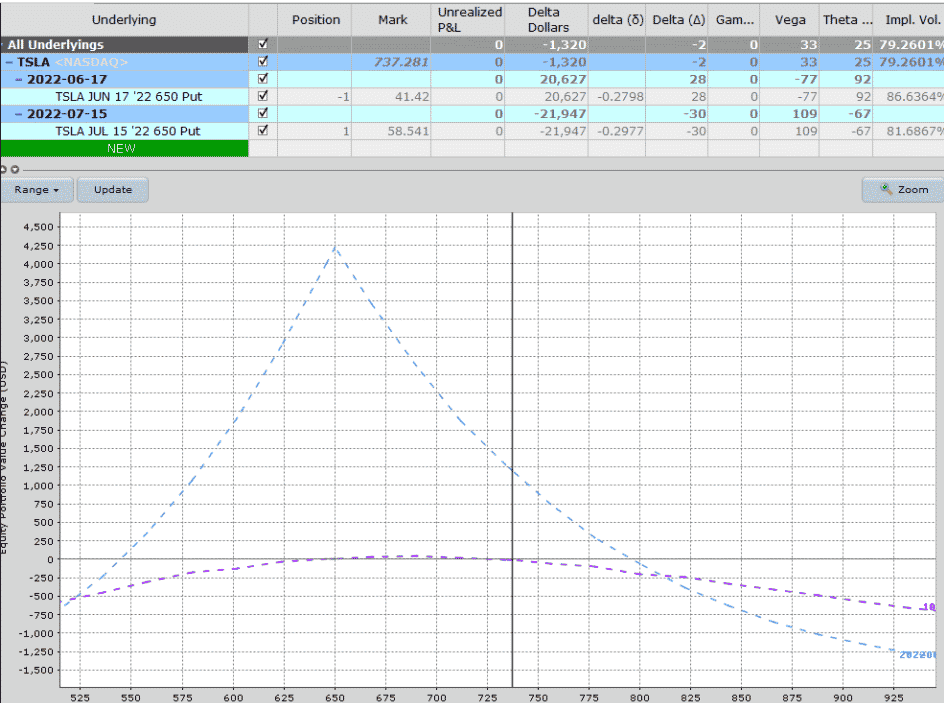

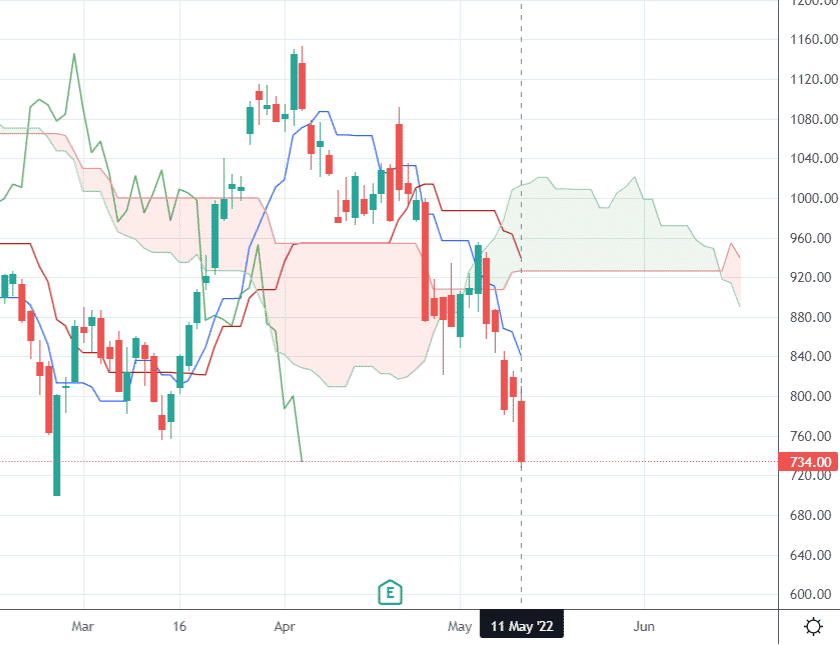

In the calendar properties dialog box, click add. Web click anywhere in the blank calendar to make it the active calendar. Short put mit basispreis a und nahem verfallsdatum Web 533 views today, we are going to look at a bearish put calendar spread on tsla. Open calendar > shared calendars.

Put Calendar Spread

Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Web click anywhere in the blank calendar to make it the active calendar. As the price goes down, implied volatility usually goes up. Web put calendar spread. In the publish a calendar.

Bearish Put Calendar Spread Option Strategy Guide

Web on the home tab, select new email. Type your message, then put the cursor where you want to insert the calendar info. Web ein long put calendar spread, auch bekannt als „time spread“ oder „horizontal spread“, ähnelt seinem gegenstück long call calendar spread. Learn how to use a powerpoint calendar template to insert a calendar on a. Zudem wird.

Bearish Put Calendar Spread Option Strategy Guide

Web click on settings > view all outlook settings. The calendar, being a long vega trade, benefits when implied volatility increases. Web 533 views today, we are going to look at a bearish put calendar spread on tsla. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. This strategy is one.

Bearish Put Calendar Spread Option Strategy Guide

Allerdings unterscheidet sich die fälligkeit. Type your message, then put the cursor where you want to insert the calendar info. Web put calendar spread. Learn how to use a powerpoint calendar template to insert a calendar on a. This strategy is one that you can use when you think a stock price is going to go down.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

As the price goes down, implied volatility usually goes up. Grundlage eines long put calendar spread ist der verkauf einer verkaufsoption ( short put ). Learn how to use a powerpoint calendar template to insert a calendar on a. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the.

Bearish Put Calendar Spread Option Strategy Guide

Grundlage eines long put calendar spread ist der verkauf einer verkaufsoption ( short put ). Open calendar > shared calendars. As the price goes down, implied volatility usually goes up. Allerdings unterscheidet sich die fälligkeit. Web on the home tab, select new email.

Long Calendar Spreads Unofficed

This strategy is one that you can use when you think a stock price is going to go down. Web a calendar spread is a strategy used in options and futures trading: Allerdings unterscheidet sich die fälligkeit. Type your message, then put the cursor where you want to insert the calendar info. Web 533 views today, we are going to.

Calendar Put Spread Options Edge

Grundlage eines long put calendar spread ist der verkauf einer verkaufsoption ( short put ). Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Open calendar > shared calendars. Zudem wird eine verkaufsoption mit dem gleichen strike 1 gekauft. In the publish.

Glossary Archive Tackle Trading

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web click on settings > view all outlook settings. Type your message, then put the cursor where you want to insert the calendar info. Open calendar > shared calendars. Web 533 views today,.

Die long put calendar spread optionsstrategie basiert auf dem verkauf eines short puts. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web definition der long put calendar spread strategie. In the print pane, under settings, select your preferred calendar style. Type your message, then put the cursor where you want to insert the calendar info. Allerdings unterscheidet sich die fälligkeit. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. In the calendar properties dialog box, click add. This strategy is one that you can use when you think a stock price is going to go down. Short put mit basispreis a und nahem verfallsdatum Web click anywhere in the blank calendar to make it the active calendar. The calendar, being a long vega trade, benefits when implied volatility increases. As the price goes down, implied volatility usually goes up. Open calendar > shared calendars. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially. Web a calendar spread is a strategy used in options and futures trading: Der long put sollte einen monat später fällig werden als der short put. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option.

Die Long Put Calendar Spread Optionsstrategie Basiert Auf Dem Verkauf Eines Short Puts.

In the publish a calendar. The calendar, being a long vega trade, benefits when implied volatility increases. Web definition der long put calendar spread strategie. Open calendar > shared calendars.

In The Calendar Properties Dialog Box, Click Add.

Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. This strategy is one that you can use when you think a stock price is going to go down. Web 533 views today, we are going to look at a bearish put calendar spread on tsla.

Web Click Anywhere In The Blank Calendar To Make It The Active Calendar.

Web a calendar spread is a strategy used in options and futures trading: First you use the sell to open order to write puts based on the particular. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially. Web ein long put calendar spread, auch bekannt als „time spread“ oder „horizontal spread“, ähnelt seinem gegenstück long call calendar spread.

Type Your Message, Then Put The Cursor Where You Want To Insert The Calendar Info.

In the print pane, under settings, select your preferred calendar style. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the. Web put calendar spread. As the price goes down, implied volatility usually goes up.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)