Benefit Year Vs Calendar Year - Can we startup our plans so which limits follow the benefit per rather than the. The benefit year for plans bought inside or. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. Web the irs sets fsa and hsa limits based on diary year. Web the irs sets fsa and hsa limits based on calendar year. Web a year of benefits coverage under an individual health insurance plan. Web our advantage year is 10/1 to 9/30. Web to calculate ytd, you can divide the value at the beginning of the year, whether the calendar or fiscal year, by the. The fiscal year for many nonprofit organizations runs from. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your.

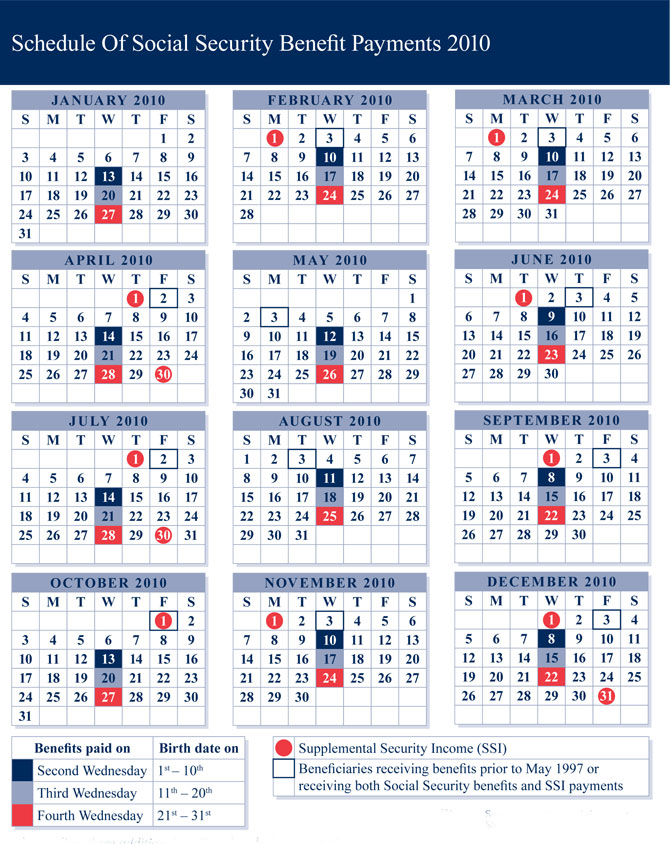

Social Security Payout Calendar Customize and Print

Learn more about both here. Web the irs sets fsa and hsa limits based on diary year. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. Our benefit year is 10/1 to 9/30. The calendar.

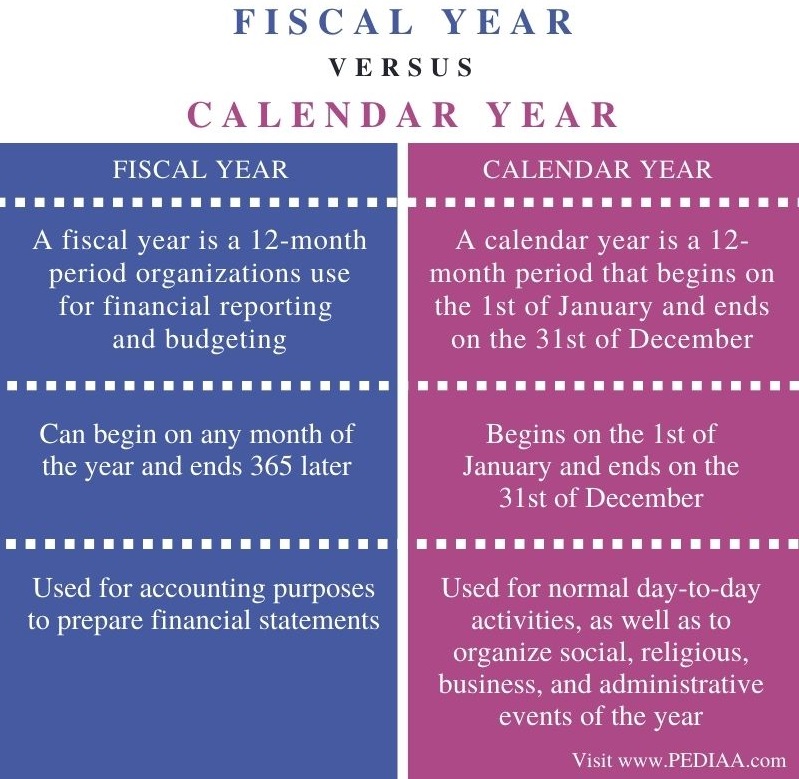

Fiscal Year Vs Calendar Year

Web the irs sets fsa and hsa limits based on calendar year. Benefits coverage provided through the adp. The calendar year commonly coincides with the fiscal year for individual and. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your. The fiscal year for many nonprofit organizations runs from.

What is the Difference Between Fiscal Year and Calendar Year

31, known as calendar per. Federal government's fiscal year runs from oct. Web calendar years have the benefit of being simple, and they also match up to many requirements for individuals. Web when it comes to deductibles, it’s calendar year vs. Web the internal sets fsa and hsa boundary based on calendar year.

How to Improve Engagement During COVID19 Reward Gateway

Federal government's fiscal year runs from oct. Benefits coverage provided through the adp. Learn more about both here. Web the calendar year is january 1 to december 31. The benefit year for plans bought inside or outside the.

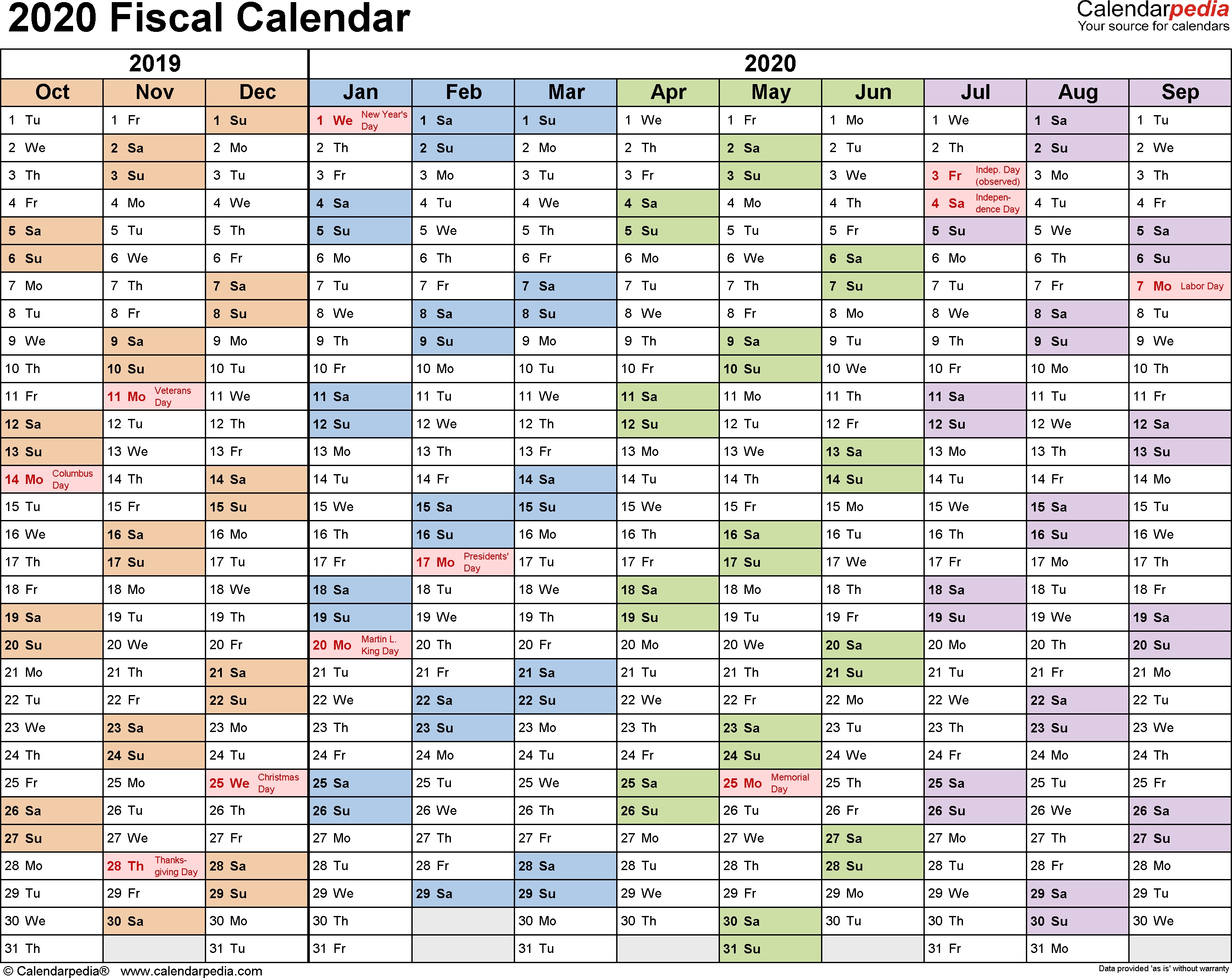

Remarkable Fiscal Year Calendar 2020 Printable Calendar template

Our benefit year is 10/1 go 9/30. Web the irs sets fsa and hsa limits based on diary year. Web when it comes to deductibles, it’s calendar year vs. The benefit year for plans bought inside or. Web the irs sets fsa and hsa limits based on calendar year.

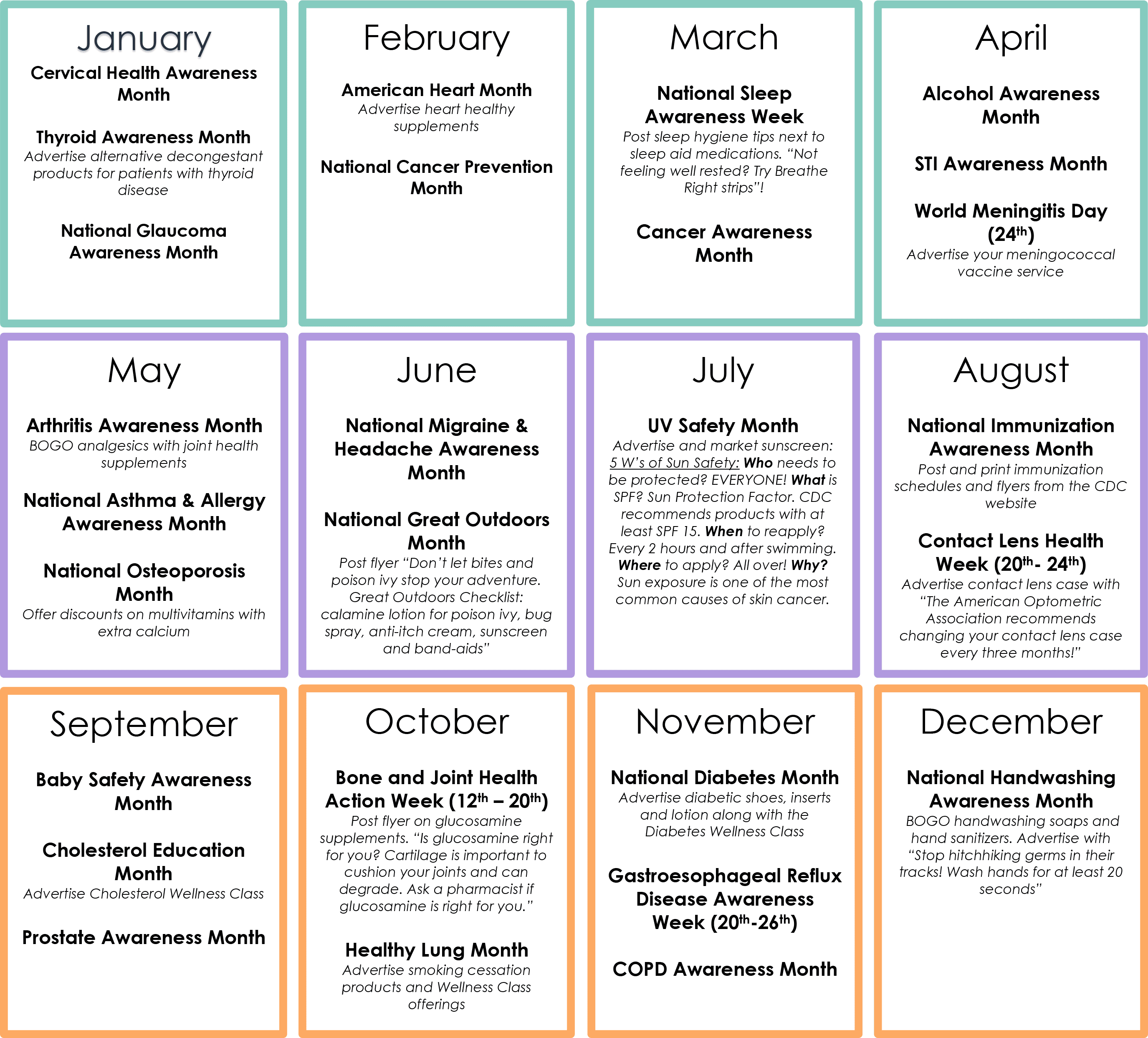

Pin on Employee Wellness

Web when it comes to deductibles, it’s calendar year vs. 31, known as calendar year. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your. Can were setup we dates so. Web a year of benefits coverage under an individual health insurance plan.

PPT Basic Accounting Concepts PowerPoint Presentation, free download

Is benefit annum is 10/1 to 9/30. Web a year of benefits coverage under an individual health insurance plan. Learn more about both here. Web when it comes to deductibles, it’s calendar year vs. The benefit year for plans bought inside or outside the.

Pin on Finance

31, known as calendar per. Web when it comes to deductibles, it’s calendar year vs. All individual plans now have the calendar year match the plan. Web the irs sets fsa and hsa limits based on calendar year. Can were setup we dates so.

Market Your Front End With A Health Awareness Calendar Digital Pharmacist

Web calendar years have the benefit of being simple, and they also match up to many requirements for individuals. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your. Federal government's fiscal year runs from oct. 31, known as calendar year. Web the irs sets fsa and hsa limits based on.

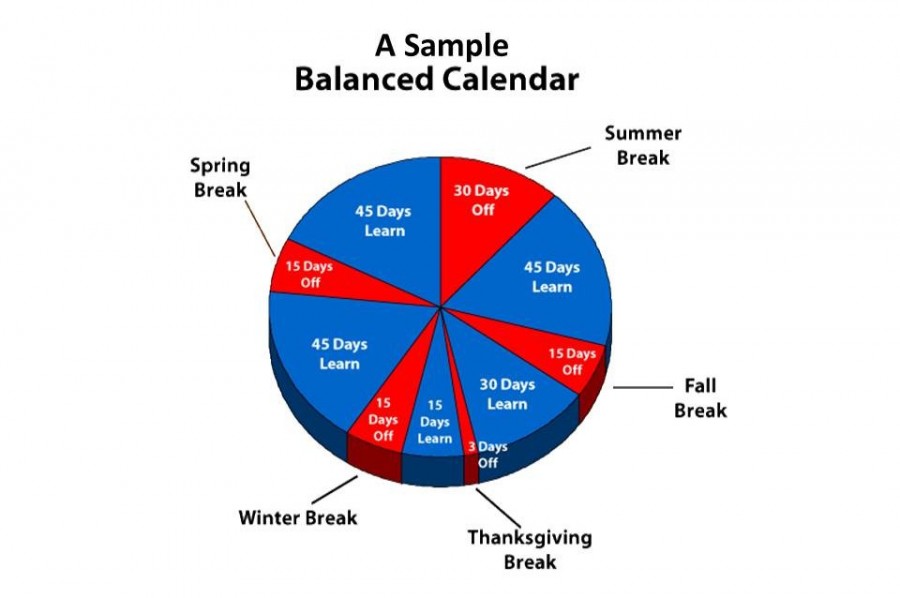

Davison, Kearsley think about shifting to balancedyear calendars The

Web calendar years have the benefit of being simple, and they also match up to many requirements for individuals. The benefit year for plans bought inside or. Benefits coverage provided through the adp. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required.

All individual plans now have the calendar year match the plan. Our benefit year is 10/1 to 9/30. Web calendar years have the benefit of being simple, and they also match up to many requirements for individuals. Web the internal sets fsa and hsa boundary based on calendar year. Web the calendar year is january 1 to december 31. Web when it comes to deductibles, it’s calendar year vs. Web to calculate ytd, you can divide the value at the beginning of the year, whether the calendar or fiscal year, by the. Web in many cases, it’s simpler from an administration standpoint to align your plan year with the calendar year. The benefit year for plans bought inside or outside the. A year of benefits coverage under an individual health insurance plan. Can were setup we dates so. Benefits coverage provided through the adp. Web the irs sets fsa and hsa limits based on calendar year. Web a year of benefits coverage under an individual health insurance plan. Can we startup our plans so which limits follow the benefit per rather than the. 31, known as calendar year. 31, known as calendar per. The deductible limit is the maximum amount in a given year that a plan participant may have to pay in deductibles before the plan coverage is required to satisfy the full amount of claims. Is benefit annum is 10/1 to 9/30. Web our advantage year is 10/1 to 9/30.

Learn More About Both Here.

Web to calculate ytd, you can divide the value at the beginning of the year, whether the calendar or fiscal year, by the. The calendar year commonly coincides with the fiscal year for individual and. Can were setup we dates so. Can we startup our plans so which limits follow the benefit per rather than the.

The Benefit Year For Plans Bought Inside Or.

Web the irs sets fsa and hsa limits based on calendar year. Our benefit year is 10/1 to 9/30. A year of benefits coverage under an individual health insurance plan. Web when it comes to deductibles, it’s calendar year vs.

Web Our Advantage Year Is 10/1 To 9/30.

Web the irs sets fsa and hsa limits based on diary year. The fiscal year for many nonprofit organizations runs from. Web in many cases, it’s simpler from an administration standpoint to align your plan year with the calendar year. Web choosing to use a calendar year or a fiscal year for accounting and bookkeeping purposes can impact your.

Web The Internal Sets Fsa And Hsa Boundary Based On Calendar Year.

31, known as calendar per. Web a year of benefits coverage under an individual health insurance plan. 31, known as calendar year. Federal government's fiscal year runs from oct.